Get the free credit dispute letter form

Get, Create, Make and Sign

How to edit credit dispute letter online

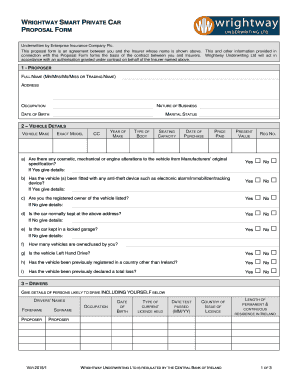

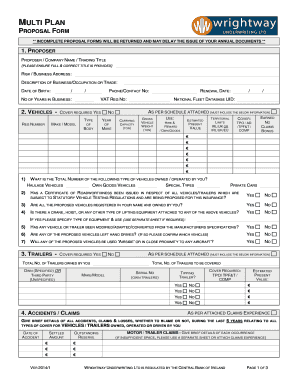

How to fill out credit dispute letter form

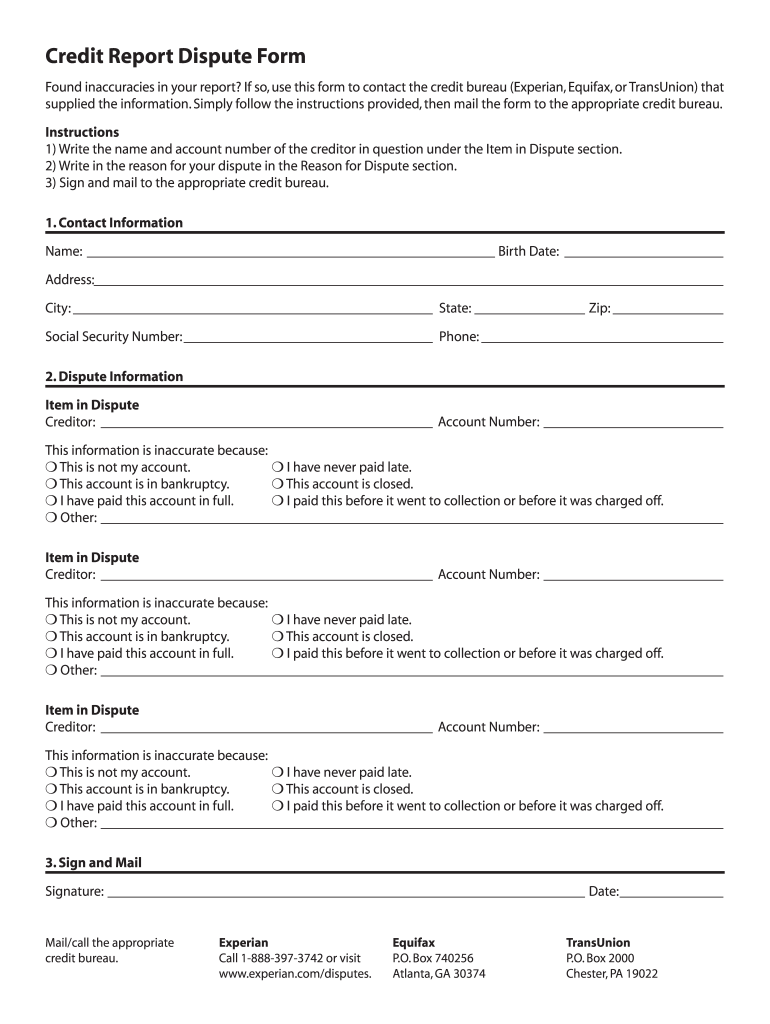

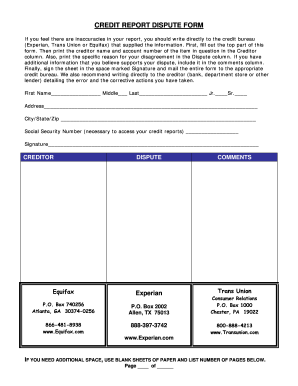

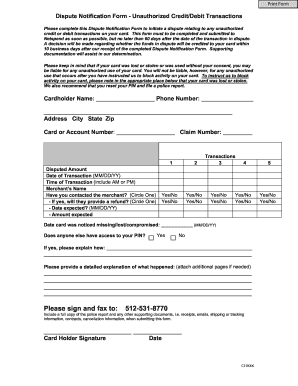

To fill out a credit dispute letter, follow these steps:

Who needs a credit dispute letter?

Video instructions and help with filling out and completing credit dispute letter

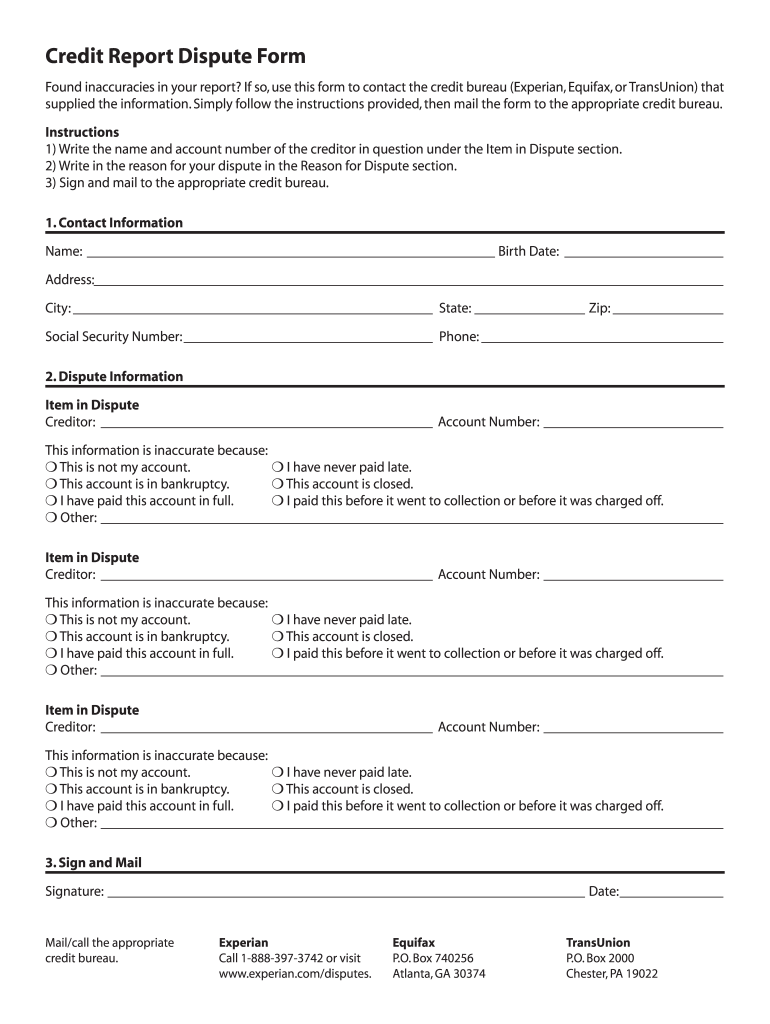

Instructions and Help about printable credit dispute letters form

Your credit report it's not terribly exciting, but it could keep you from enjoying some of life's most exciting milestones buying a car owning a home even getting a new job, so it's important to check in on your credit every once in a while you want to know where you stand, and you also want to watch out for any credit report errors to find and dispute errors on your credit report you'll first need to obtain a copy of it you'll see a lot of websites and advertisements boasting free credit reports and scores the only one that's truly free no strings attached annual credit report.com by law you're entitled to a free copy of your report each year from each of the three major credit bureaus that's TransUnion Equifax and Experian let's say you get a copy of your report and everything looks clean well then you're good to go but what if you find an error here's what you should do step 2 dispute errors you'll need to write a letter to the bureau telling them what information is inaccurate you can find a sample letter on credit cards calm don't use the online form provided by the bureau it limits how much proof you can attach and may require you to sign away some of your rights here's what your correspondence should include copies of documents that prove your claim a clear identification of the error state the facts briefly and simply and request a deletion or correction you may also want to include a copy of your credit report step 3 keep records once your letter is written to keep a copy if you're mailing it send it certified and keep the receipt once your letter is received the bureau's have to reinvestigate the item in question usually within 30 days they'll also notify the party holding the error that's probably a bank or a lender for example if there's an error all credit bureaus will be notified, so your report can be updated if your reports been changed you'll get another free copy of it and if your report is updated you can request the bureau's to send correction notices to anyone who's pulled your report in the past six months if your dispute is denied you may at a 100-word statement to your report describing your side of the dispute it's worthwhile to periodically check your credit report if you do spot an error you'll want to tackle it as soon as you can Kristen Wong Car cards calm

Fill credit dispute letters : Try Risk Free

People Also Ask about credit dispute letter

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your credit dispute letter form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.