Experian Credit Report Dispute Form free printable template

Show details

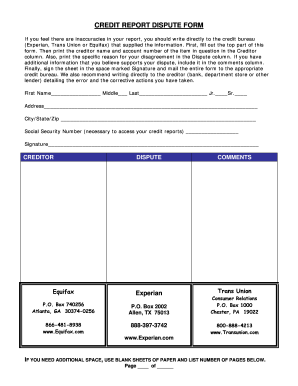

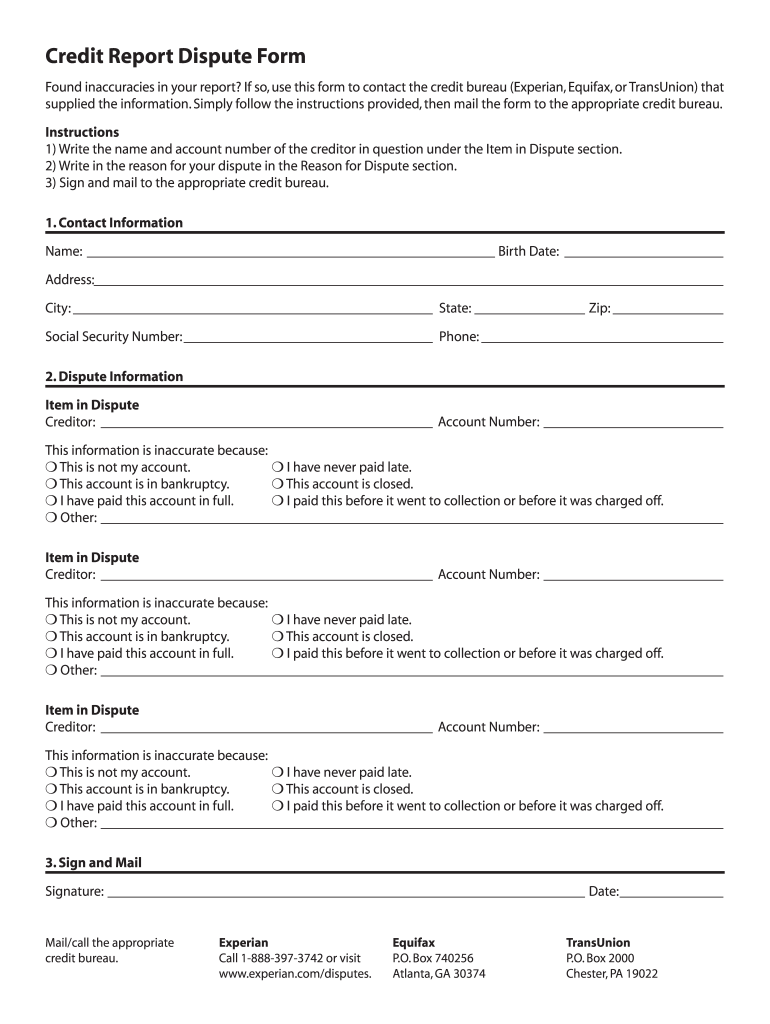

Credit Report Dispute Form Found inaccuracies in your report If so use this form to contact the credit bureau Experian Equifax or TransUnion that supplied the information. Simply follow the instructions provided then mail the form to the appropriate credit bureau. Instructions 1 Write the name and account number of the creditor in question under the Item in Dispute section* 2 Write in the reason for your dispute in the Reason for Dispute section* 3 Sign and mail to the appropriate credit...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign dispute letters form

Edit your credit dispute letter template form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your printable credit dispute letters pdf form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit credit dispute letter pdf online

Use the instructions below to start using our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit printable credit dispute letters form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out experian dispute form

How to fill out Experian Credit Report Dispute Form

01

Obtain the Experian Credit Report Dispute Form from the Experian website or customer service.

02

Fill in your personal details including your name, address, and Social Security number.

03

Indicate the specific item(s) on your credit report that you are disputing.

04

Provide a clear explanation of why you believe the information is incorrect.

05

Attach any supporting documents that validate your claim.

06

Review the form for accuracy and completeness.

07

Sign and date the form.

08

Submit the form via mail or online, depending on the instructions provided by Experian.

Who needs Experian Credit Report Dispute Form?

01

Individuals who believe there is incorrect information on their Experian credit report.

02

Consumers seeking to improve their credit score by disputing negative items.

03

Anyone who has been a victim of identity theft and needs to correct their credit report.

04

Borrowers preparing for major financial decisions, such as applying for a mortgage or loan.

Fill

transunion dispute form

: Try Risk Free

People Also Ask about credit dispute letters that work

What is Form 604?

Lobbyists are required to complete Form 604 (Lobbyist Certification Statement) and provide a recent photograph (head and shoulders only). • The Form 604 must be filed with the Secretary. of State as an attachment to one of the following: -- your lobbying firm's registration, Form 601, or.

What is the difference between a 604 and 609 dispute letter?

A 609 letter can help you verify information and identify errors on your credit report. It can also uncover “hidden” details that don't show up in your free credit report. Section 604 explains the circumstances in which the credit bureaus can release your credit information to various entities.

What is the permissible purpose of the 604?

Section 604(a)(3)(F)(ii). To determine a consumer's eligibility for a license or other benefit granted by a governmental instrumentality required by law to consider an applicant's financial responsibility or status.

What is a 604 letter from a Fair credit Act?

What is a 604 dispute letter? A 604 dispute letter asks credit bureaus to remove errors from your report that fall under section 604 of the Fair Credit Reporting Act (FCRA). While it might take some time, it's a viable option to protect your credit and improve your score.

How do I write a letter to remove collections from my credit report?

I am writing in regards to the above-referenced debt to inform you that I am disputing this debt. Please verify the debt as required by the Fair Debt Collection Practices Act. I am disputing this debt because I do not owe it. Because I am disputing this debt, you should not report it to the credit reporting agencies.

What is the difference between a 609 and 604 dispute letter?

A 609 letter can help you verify information and identify errors on your credit report. It can also uncover “hidden” details that don't show up in your free credit report. Section 604 explains the circumstances in which the credit bureaus can release your credit information to various entities.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send credit dispute letters for eSignature?

When you're ready to share your credit removal letter, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

Can I sign the experian dispute form electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your pdf credit dispute and you'll be done in minutes.

Can I create an electronic signature for signing my 609 letter in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your equifax dispute form and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

What is Experian Credit Report Dispute Form?

The Experian Credit Report Dispute Form is a document used by consumers to contest inaccuracies or errors found in their Experian credit report.

Who is required to file Experian Credit Report Dispute Form?

Any consumer who identifies incorrect or incomplete information on their Experian credit report is required to file the dispute form to initiate the correction process.

How to fill out Experian Credit Report Dispute Form?

To fill out the form, provide your personal information, identify the inaccuracies in your credit report, and specify the corrections needed, then submit it as directed.

What is the purpose of Experian Credit Report Dispute Form?

The purpose of the form is to allow consumers to report and seek correction of errors in their credit reports, ensuring accurate credit histories.

What information must be reported on Experian Credit Report Dispute Form?

The form requires personal identification information, details of the disputed entry, and an explanation of why you believe the information is incorrect.

Fill out your Experian Credit Report Dispute Form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

609 Dispute Letter is not the form you're looking for?Search for another form here.

Keywords relevant to dispute letter

Related to transunion credit dispute form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.